On April 8, the Chief Executive of Hong Kong SAR (Special Administrative Region), Carrie Lam, unveiled a HK$137.5 billion (US$18 billion) lifeline for businesses and individuals to help ailing businesses stay afloat, and retain workers as the city continues to reel from the catastrophic economic effects of the coronavirus (COVID-19) pandemic, and prolonged periods of social unrest.

This will be the third and largest stimulus package rolled out by the Hong Kong government this year, following the first round epidemic fund of HK$30 billion (US$4 billion), and the HK$120 billion (US$15.5 billion) worth of relief measures introduced in the Hong Kong 2020-2021 Budget.

Complementing the relief measures, Carrie Lam has announced that her salary, along with that of her office, and the Principal’s office will take a 10 percent pay cut for the next 12 months – in a sign of solidarity and unity so that Hong Kong “can ride out this storm and relaunch.”

The city had confirmed 253 new COVID-19 cases in the week leading up to the announcement, taking the total to 936 on the day of the announcement.

The Hong Kong government is now focusing its attention on job retention, reskilling its workers and creating new jobs to sustain its workforce, and to ensure its economy is well-placed for a speedy recovery once the epidemic is contained. Here we highlight the details of the relief measures within the recently announced Anti-Epidemic Fund 2.0.

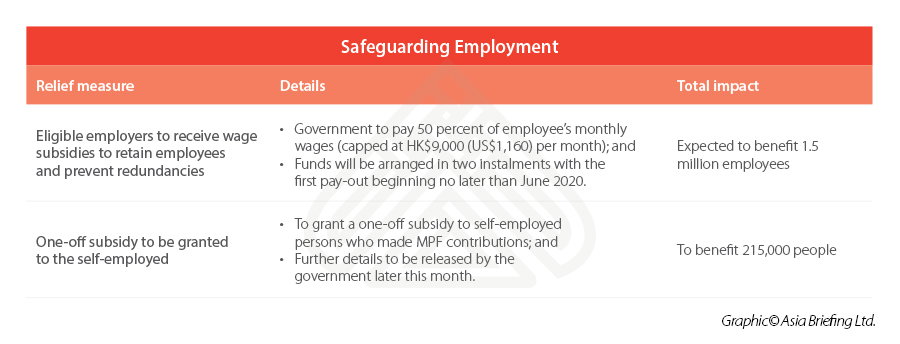

One of the most significant lifelines offered within this stimulus package is the HK$80 billion (US$10 billion) earmarked for the Employment Support Scheme.

Under this scheme, the Hong Kong government will issue wage subsidies to eligible employers in order to encourage enterprises to retain employees, and prevent mass lay-offs from occurring during these difficult times.

Eligible employers are those who meet the following two conditions:

The wage subsidy is calculated based on 50 percent of an employee’s monthly salary, which is capped at HK$18,000 (US$2,322) for a period of six months. In this case, the amount of the wage to be paid by the government under such subsidy is at a maximum of HK$9,000 (US$1,160) per employee per month.

For self-employed person(s) contributing to MPF, a one-off subsidy will be provided. No further details have been released at this point, but more information is expected to be released by the end of the month.

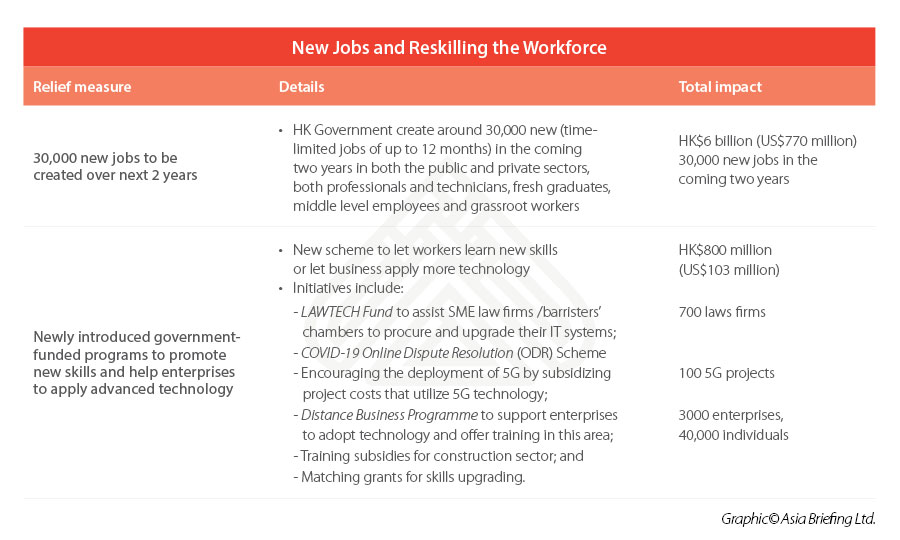

To prevent redundancies in the future, the government pledges to create 30,000 new (time-limited jobs) and endeavors to expedite the upskilling and technological advancement of businesses in traditional industries, such as the legal and construction industry. Details are laid out below.

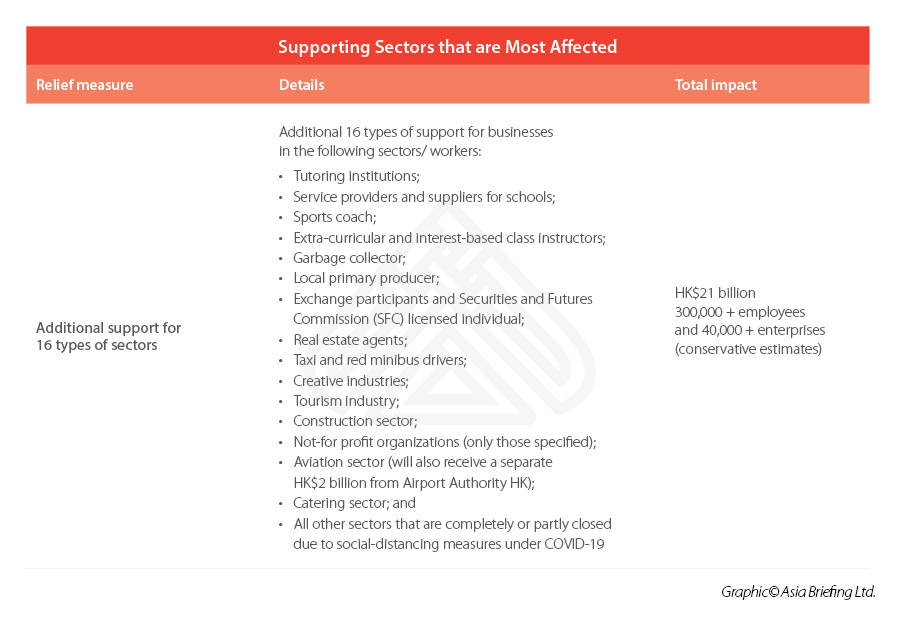

Recognizing that some businesses were hit harder by the COVID-19 pandemic than others, the government has taken to providing a series of tailored responses for 16 types of sectors that have predominantly customer-facing operations.

Hard-hit sectors, such as tutorial schools, tourism industry, construction sector, aviation sector, catering sector, and entertainment sectors will be granted an individualized once-off relief package, details of which can be found on the government website.

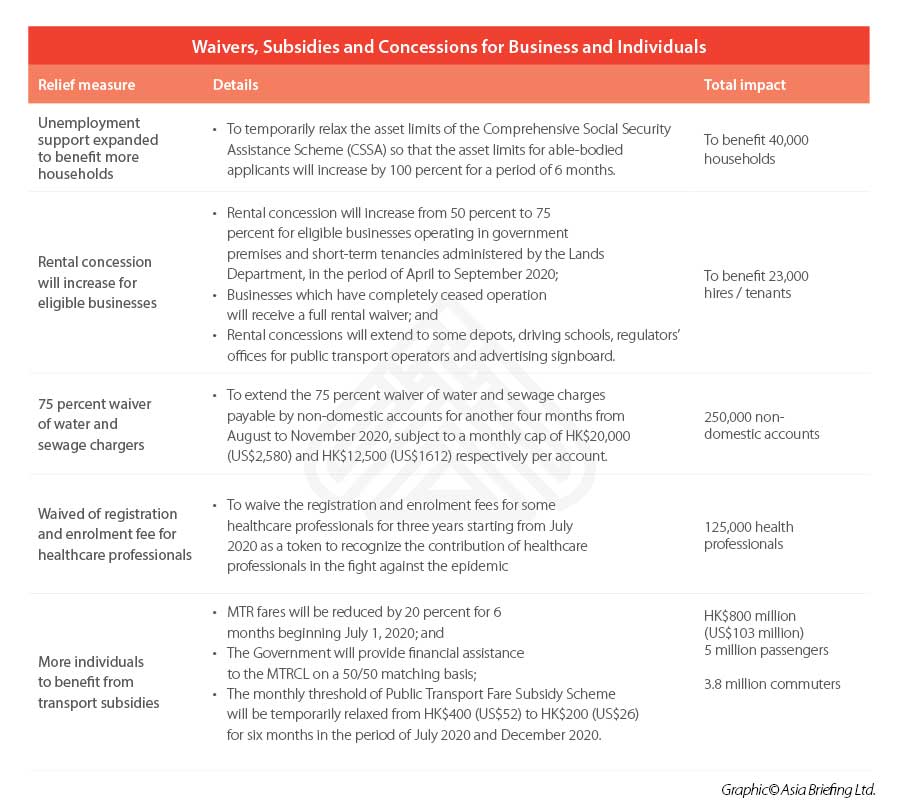

Alongside the various employment-related assistance, the government has also introduced a series of measures that aim to ease the cashflow and burden of businesses and individuals – in the form of rental, utility, and transport subsidies. See below for more details.

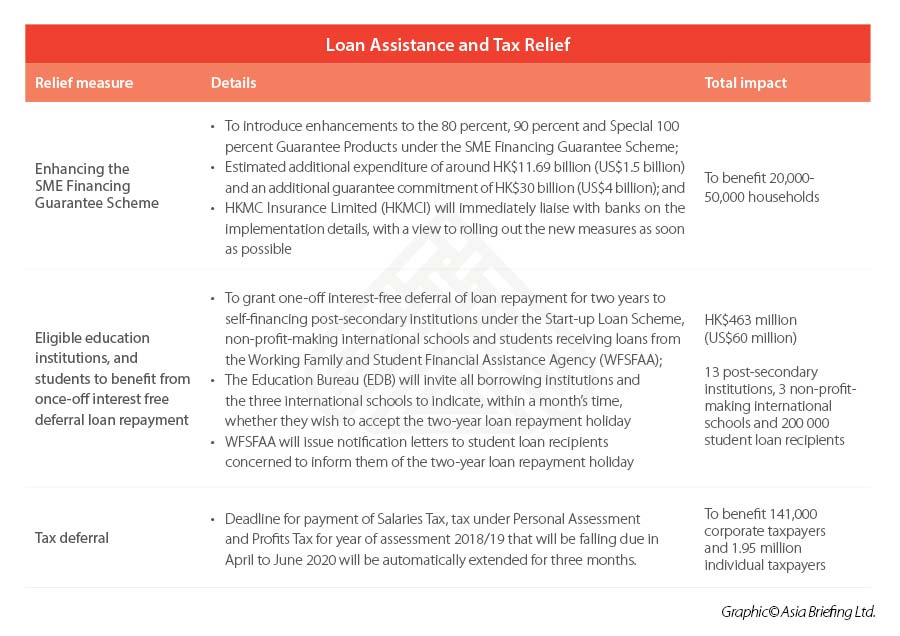

Another strategy adopted by the government is to make it easier for businesses and individuals to obtain loans, while also deferring the deadline for payments tax to temporarily relieve the tax burden felt by individuals and businesses.

Under this new relief package, the government will enhance the SME Financing Guarantee Scheme by introducing 80 percent, 90 percent, and Special 100 percent Guarantee Products and local banks in Hong Kong are set to roll out the offers for such products.

The deadline for payment of tax for year of assessment 2018/19 will be automatically extended for three months. As announced by the Inland Revenue Department in December, businesses and individual taxpayers who are facing financial difficulties can submit an application to the Inland Revenue Department requesting to pay the tax by installments within a maximum period of 12 months from the original due date.

The Hong Kong (SAR) Government is expected to provide further details of the conditions and requirements for applying above schemes and subsidies in coming few weeks. Businesses are recommended to stay in touch with their legal and tax advisors in Hong Kong to receive timely updates.

You may also refer to our article Hong Kong Budget 2020-2021 from our online publication China Briefing for the relief measures proposed under the Hong Kong Budget earlier this year.

For further information please don’t hesitate to contact Dezan Shira & Associates’ Corporate Accounting Services Senior Manager, Jennifer Lu at Jennifer.lu@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

Our free webinars are packed full of useful information for doing business in China.

Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

Subscribing grants you this, plus free access to our articles and magazines.

Subscribe to receive weekly China Briefing news updates,

our latest doing business publications, and access to our Asia archives.

Sign up for your complimentary subscription to our weekly newsletter here.

No subscription charges!

Type keyword to begin searching…